(Lawyernomics 10/27/2016)

Solo law practice and small law firm owners frequently see themselves as engaging in a noble profession that offers services no one else can. The skills and training lawyers get to provide effective legal representation makes them see the law as set apart from any other profession. And it is.

But, if you’re a solo or small firm owner, a law firm is like any other consultancy or small business. If haven't structured your law practice properly, you will operate your law business poorly. Enterprises that aren’t well run, regardless of their offerings, struggle and frequently fail. This law firm business plan can help prevent that outcome.

(Lawyernomics 9/26/2016)

Law firm data represents a valuable target for hackers. So, it's no longer if but when your solo or small law practice will get hacked. In this post, we tell you how to prevent cybersecurity disaster as if your legal practice depends on your acting now—because it does.

(Lawyernomics 10/20/2016)

Networking is hard work that takes skill. But, with a clear set of strategies, effort, and time, you can master it and turn your network into increased net worth for your law practice—or any business. Read this blog post where I show readers how.

(The Mortgage Reports 11/1/2016)

This blog post shows readers how five real homeowners who live in cold US climates are winterizing their homes.

(Lawyernomics 9/19/2016)

No legal practice is too small to be hacked. Your firm's electronic devices and network contains valuable personal data hackers want to access and sell. Have you addressed this serious vulnerability faced by nearly all small businesses, including your solo or small law firm? Here's why you must.

(5ArchFunding.com 9/28/2016)

One of the biggest challenges REIs have with rentals is keeping up with expenses, especially unpredictable ones. Anything can happen at any time, and landlords must always be prepared for contingencies. A rental maintenance account could help. Here's what to consider when you establish yours.

(LendingTree.com 3/18/2015)

Often, consumers find they need extra funds in order to meet specific needs or finance a purchase. Two options that appear similar but have definite pros and cons are the credit card and the personal line of credit. Check out their similarities and differences before choosing one or the other.

(LendingTree.com 3/30/2015)

Is your mortgage lender licensed? You'd better make sure or you might have your mortgage loan check marked "insufficient funds" at closing time.

(TrustedChoice.com 9/11/2015)

Have you always wondered the correct way to buy furniture? Well, I interviewed a New York interior designer and a Los Angeles custom furniture maker to learn how to buy high-quality furniture at an affordable price.

(Avalara Trustfile Blog 9/13/2015)

When to apply the appropriate sales tax" can be a complicated question. You have to ask, "Is every aspect of each transaction taxable, including shipping and handling?" This article answers that question.

(TrustedChoice.com 4/28/2015)

Are you considering consolidating your student loans? When should you do so and when is it not a good idea? Read my article on TrustedChoice.com's new blog, My Choice Guide, and know what to consider when consolidating your student loans.

(TrustedChoice.com 4/28/2015)

It used to be if you had a pulse, you could get a mortgage loan using stated income. Not anymore. It's become much harder for everyone to get a mortgage, including small business owners. But, it's doable and here, you learn how.

(TrustedChoice.com 4/28/2015)

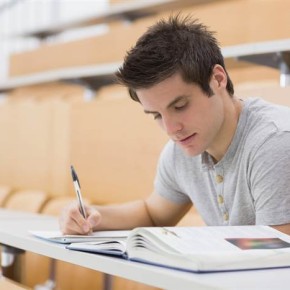

Do you want to go to college without going into debt? You can with scholarships. In fact, you can fund your entire education with scholarships. This article I wrote for Trusted Choice.com's blog, My Choice Guide, will give you real strategies for doing just that. Read and share with others.

(Avalara Trustfile Blog 9/14/2015)

Reseller sales tax compliance and management can be complex, with different rules for different states and even different rules within states. The terminology can be daunting and the potential for missteps real. Here's how to avoid the five most common mistakes.

(Image Credit: Stuart Miles http://bit.ly/1FiKrI6)

(TrustedChoice.com 4/28/2015)

Are you setting yourself up to be among the nine million people that the Federal Trade Commission estimates have their identities stolen each year? You may be doing so by the way you use social media, especially Facebook.

(Avalara TrustFile Blog 7/24/2015)

45 states require your business to collect and remit sales tax if you have nexus in them and are selling taxable goods and services. But, with so many rules and jurisdictions, it's easy to make mistakes. Avoid these five if you don't want to get burned.

(Avalara TrustFile Blog 7/27/2015)

Like any other business, an ecommerce business is serious business. You won't get rich quick launching one, but you will be broke fast if you don't keep it streamlined from startup by using the proper tools and strategies to operate the enterprise. Here are 5 you can use to do just that.

(TrustedChoice.com 7/28/2015)

Choosing a strong password is critical for keeping your digital assets safe. This article provides you a formula for creating good passwords and resources for storing them securely.

(TrustedChoice.com 8/21/2015)

Do you have exceptional credit? Then you have exceptional choices in credit cards. Here are 3 questions to ask when you're choosing them.

(TrustedChoice.com 8/6/2015)

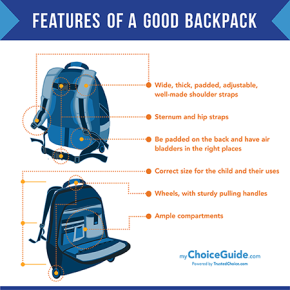

Many of the 79 million students returning to school will carry a heavy load to in their backpack. This is especially true if they're starting middle school, where they carry more books, supplies, equipment, and electronics than before. Here's how to choose the right backpack for your kids.

(TrustedChoice.com 4/28/2015)

Your home is one of the biggest investments you'll make during your lifetime, and the process of buying and selling can be emotional and stressful. You'll need the right real estate agent for the transaction.

(TrustedChoice.com 5/11/2015)

If you're looking for a new depository institution for your small business, consider a credit union. Why? Your business will be an member-shareholder, which means it, along with other members control the institution. And, you'll get the best combinations of high returns and low fees. Read more here.

(TrustedChoice.com 6/17/2015)

Among the fastest ways to rebuild your credit, we said, is with a car loan. A form of an installment loan, it's payable in monthly installments over a set number of months. And, that payment history is the way in which you rebuild your credit. There are three steps to this process.

(Image Credit: Stuart Miles http://bit.ly/1FiKrI6)

(TrustedChoice.com 7/29/2015)

Choosing the right cutlery for your kitchen (or as a gift for someone else's) can be a daunting task when you want to make the right choice for both your needs and budget. In this article, we interview two pro chefs and a bladesmith to help you choose kitchen knives like a master chef.

(TrustedChoice.com 10/29/2015)

Choosing a charity to which to give your hard-earned money can be tricky, especially with all the scams being perpetrated. However, if you know the rules, you can find charities that work for you and feel great giving. Here are the right questions to ask when choosing a charity.

(TrustedChoice.com 2/5/2016)

Many people think that buying foreclosures are a quick way to make money. But, it's also a fast way to buy a whole lot of trouble if you don't know what you're doing. Read this article first if you're considering getting into real estate investment by buying foreclosures.

(Image Credit: Stuart Miles http://bit.ly/1FiKrI6)

(TrustedChoice.com 2/5/2016)

The TV shows make flipping look fun, easy and profitable. But, it's seriously risky business, especially for newbies. While you can’t avoid risk entirely in this business, you can mitigate it by learning to flip homes the smart way. This article provides some solid tips for doing that.

(TrustedChoice.com 4/6/2016)

Everyone should see a financial planner to make sure they are on track to reaching their financial goals. You don't have to hire one immediately but getting help from one to get started is critical. Here are six questions you should ask when hiring one.

(TrustedChoice.com 4/19/2016)

Are you considering investing online but are unsure how to do so without losing your money? Then, this must-read article is your next important one. Get advice from the best in the business about how to invest right using online platforms.

(The Natural Stone Institute 5/26/2016)

When you have kids and pets but want the quality and beauty of natural stone, you just need to know how to choose it right. Here, I interviewed several experts to help you do that and then care for your new stone floors to keep them beautiful.

(5ArchFunding.com 4/28/2016)

Some of the biggest challenges REIs have in flipping homes are unexpected surprises during renos. You can't see behind the walls, so choosing the right residential structural engineer to inspect your flips can help you avoid expensive problems from the beginning.

(5ArchFunding.com 4/25/2016)

The tools and materials can be expensive on rehabs, but their costs also can break your budget, especially if they’re unforeseen. Here's how to save on them so they don't break your reno budget.

(New York Life Investments 6/18/2022)

Increasingly, investors are interested in aligning their investment portfolios around their environmental, social, and governance (ESG) values. Savvy financial professionals are taking the steps to identify their clients' interests and values to help them meet their investing goals. This research-backed white paper shows financial professionals how to provide customized client experiences that meet their ESG investing requirements.

(American Express 1/19/2021)

No matter what your business does, it’s essential you build relationships with a dedicated network of financial advisors. They help you operate, develop, and grow your business so you can focus on serving your customers while avoiding financial missteps. But which do you need and when do you need them? Use the guidance in this blog post to learn the right way to build your financial advisor network.

(American Express 1/19/2021)

A high volume of sales may make you feel profitable, but that’s not the same as having a strong cash flow. After all, you can appear profitable at certain times, but be in the red in others. It’s only by proactively balancing how you manage your cash flow—revenue, expenditures and profits—that you have cash to maintain business operations consistently. That allows you to take advantage of opportunities to invest in growth. Here's how to achieve that balance.

(Northern Trust FlexShares 6/18/2022)

High net worth and ultra-high net worth executive women often get overlooked by wealth management advisors as viable clients. But, this multi-trillion dollar market is a growing—and lucrative—investor segment. From this white paper, advisors learn why this important investor segment has value to them and how to reach this market.

(Inclusion of this writing sample in my portfolio does not represent an endorsement of me or my work by FlexShares or Northern Trust.)

(FinImpact 6/24/2022)

A debt consolidation loan combines multiple debts, like credit cards, personal loans, medical and others, into one loan. It allows you to pay all debt included in the loan off at once in a single monthly payment over the term of the loan. Often, its APR is lower than a single credit card added to the loan, so debt consolidation is a great option if you're trying to get your monthly payments down.

Below, I summarize the features of each loan covered here. They may be different in your state and are subject to change frequently. So, please check the lender’s site for the updated information. In this "Best of" lender list, I also provide significant education on what debt consolidation loans are, the application process, and alternatives to debit consolidation.

(Note: Clients pay me by the word for projects like this and provide detailed project briefs.) Image: Monstera on Pexels.com.

(TrustedChoice.com 4/28/2015)

Do you want to go to college but avoid college debt? Want to help your kids stay debt free for college? Then, you'll need to know how to get scholarships Read my article on Trusted Choice's new blog, My Choice Guide, to learn how to fund your entire education using scholarships

(Lawyernomics 9/19/2016)

Do you know who your ideal legal client is? It's difficult to develop a law firm content marketing strategy that distinguishes your law practice from your competitors' unless you know exactly whom you’re targeting.

That’s where a legal marketing persona becomes a crucial part of your market research. This detailed profile of your ideal legal client, which gets integrated into your legal marketing plan, will help you precisely target that potential legal client with the right editorial content that persuades them to choose your firm over your competitor's. Here's how to create them these ideal client personas.

(The Senior Beacon 7/3/2015)

The vast majority of older adults prefer to remain in their homes for as long as possible, even when they need daily assistance from an outside caregiver to meet their basic needs. Learn how those in the Washington DC area can get government help to age in place.

(The Senior Beacon 9/14/2015)

An overview of Maryland's Veteran's Affairs program, "Medical Foster Homes", which is part of a national program that makes it possible for veterans across the nation to get care in a private home.

(TODAY.com 9/18/2015)

Census data show that in 2013, 3.5 million Americans made one-way mega-commutes from their homes to their jobs. As this piece shows, there are people who travel between countries to get to work in the US each day, not just within busy metro areas or between states.

The article shows those of you who frequently make long commutes for work how to cope effectively with the stresses of such constant travel.

(TODAY.com 9/1/2015)

Based on solid financial literacy principles, this article provides a step-by-step plan to teach your kids how to avoid college debt--starting in kindergarten.

(TODAY.com 9/4/2015)

One airline has decided to weigh its passengers with their carry-on luggage to determine if they are too heavy to fly. Could that ever become a regular practice on your favorite airline?

(TODAY.com 8/4/2015)

You can fly like a rock star on a garage band budget. Even if you're not one of Delta's medallion or elite level clients, here are some options for flying on a private jet from TODAY Money.

(The Washington Informer 5/27/2015)

In honor of its 80th anniversary, Industrial Bank, the oldest (and now, only) African-American bank in D.C., held a competition to award $80,000 in grants to five local African-American-owned businesses.

(Yahoo! Finance 6/3/2016)

Should you pay down debt or save for retirement? In this article I wrote for the "Economics of You" series, I asked three personal finance experts, Gerri Detweiler, Beverly Harzog and Bruce McClary to answer this common personal finance question.

(TODAY.com 11/9/2015)

Are you considering going to a top college or university with a high tuition to match for which you'll have to take on student debt? Then, you'll want to determine whether or not that institution of higher learning is worth the investment. Read this article to get tools that will show you (or your college student) how to do just that.

(Hearst Media / WomansDay.com 5/16/2016)

Whether you're looking for career advice or the cure for a broken heart, if you read any of them, these books will stay with you long after you read their last page.

(CreditUnions.com 6/5/2016)

This Virginia credit union changed its mortgage lending paradigm to accommodate members’ availability and interests. By changing the pay structure for its MLOs, the credit union substantially increased both income opportunities for their lenders and revenue for the credit union. Moreover, member satisfaction for their mortgage clients is at an all-time high and those members maintain at least four products with the credit union.

(Forbes Advisor 6/9/2021)

Someday soon, if not today, you may find a banking platform that’s designed specifically for you and those like you. A growing number of banks and fintechs are using digital banking platforms to meet the unique challenges and needs of individual communities. This article tells the story of two of them.

(Editor's Note: In this story, Dahna Chandler profiles OneUnited Bank and E. Napoletano profiles the Daylight financial platform; Mitch Strohm wrote the introduction and conclusion.)

(Forbes Advisor 1/12/2021)

Your condo insurance policy covers only what happens within your walls. And “a master policy protects the building,” explains Scott Holeman, director of the Insurance Information Institute, a trade group. “An individual policy covers your liability, personal property and structural elements that are not covered by the master policy.” That's why you may need loss assessment coverage. Here's what it is and how to get the coverage.

(Forbes Advisor 2/12/2021)

At a time when Black-owned banks are disappearing through closure or consolidation, digital banking startup Greenwood Financial, which launched in October 2020, is showing Black banking’s resiliency with its Black- and Latinx-focused offerings. Learn more about the initiative and what systemic issues the neobank got launched to address.

(Forbes Advisor 2/2/2021)

Studies prove that, in most American homes, women still do most of the household management tasks. Increasingly, this includes handling finances. Research shows that, in nine in 10 American households, saving and spending decisions involve women, while 31% of partnered women are the primary managers of their household’s finances. Partnered or not, perhaps you’re a woman who’s decided it’s time to change your or your family’s financial picture. Let these seven women help you.

(Forbes Advisor 10/13/2020)

Frequently, questions about diversity in fintech center on gender diversity, and that gender diversity means “white women.” When any organization is predominantly white, it tends to focus on attracting customers who look like its employees and leadership—white ones, though that’s often not deliberate. Here's what Betterment is doing to change that.

(Forbes Advisor 12/11/2020)

Auto and home insurance companies look at your past claims when setting rates for you. But how do they know about your insurance past? A database called C.L.U.E. serves up your insurance history in report form. What is it, what's in yours, what does an insurer see, and how do you fix mistakes on the report?

(Forbes Advisor 6/4/2021)

Car accidents, even just fender benders, are an unfortunate fact of life. Even though fewer cars are on the road during the pandemic—16% fewer according to Zendrive, a smartphone-based driving analytics app provider—drivers might be more distracted. Phone use while driving was up 38% after lockdowns started. So, it's essential to know what to do after an car accident.

(Forbes Advisor 9/24/2020)

Launched in 1968 as Unity Bank & Trust Company in response to calls for Black economic empowerment, OneUnited Bank’s mission remains being Black America’s first choice for banking. Here’s how OneUnited is working to achieve that goal.

(Forbes Advisor adds editor names under contributor names for SEO purposes. However, I wrote this story entirely.)

(Forbes Advisor 9/2/2020)

Black-owned banks and credit unions provide a real opportunity for the Black community to overcome the racial wealth gap, and BankBlackUSA is an organization that is helping to lead that charge.

(NextAvenue.com 10/19/2017)

Numerous Americans over 50 haven’t saved for retirement. In fact, the Insured Retirement Institute found that only 54 percent of boomers (age 53 to 71) have retirement savings. Quite a few Gen X’ers over 50 have little or no retirement savings, too. The boomers and Gen X’ers are in this position for multiple reasons; the most common one is postponement. If you’re one of them, it isn’t too late to get started funding your retirement and avoid future missteps, though. Here's a smart plan to help you.